![Sage 50 Premium Accounting 2022 U.S. 5-User Small Business Accounting Software [PC Download] : Everything Else - Amazon.com Sage 50 Premium Accounting 2022 U.S. 5-User Small Business Accounting Software [PC Download] : Everything Else - Amazon.com](https://images-na.ssl-images-amazon.com/images/I/51TEmAVzpvL._AC_UL900_SR615,900_.jpg)

Sage 50 Premium Accounting 2022 U.S. 5-User Small Business Accounting Software [PC Download] : Everything Else - Amazon.com

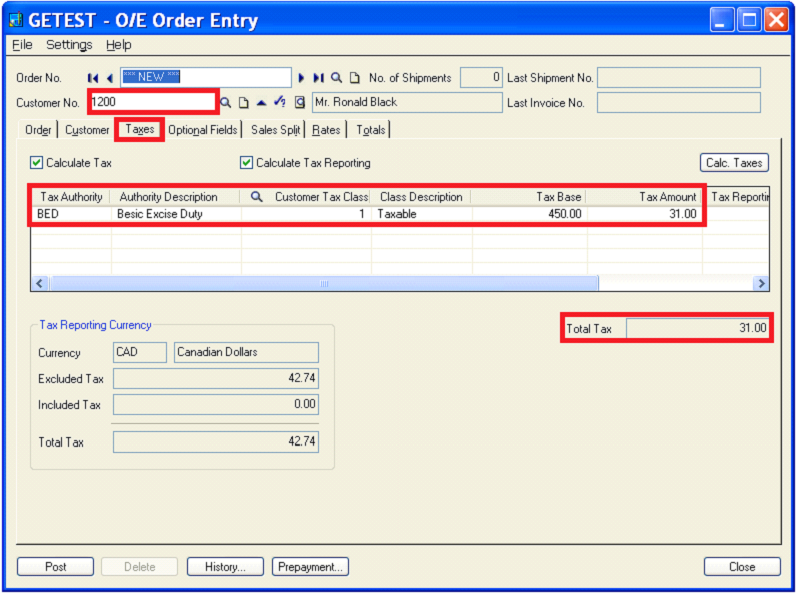

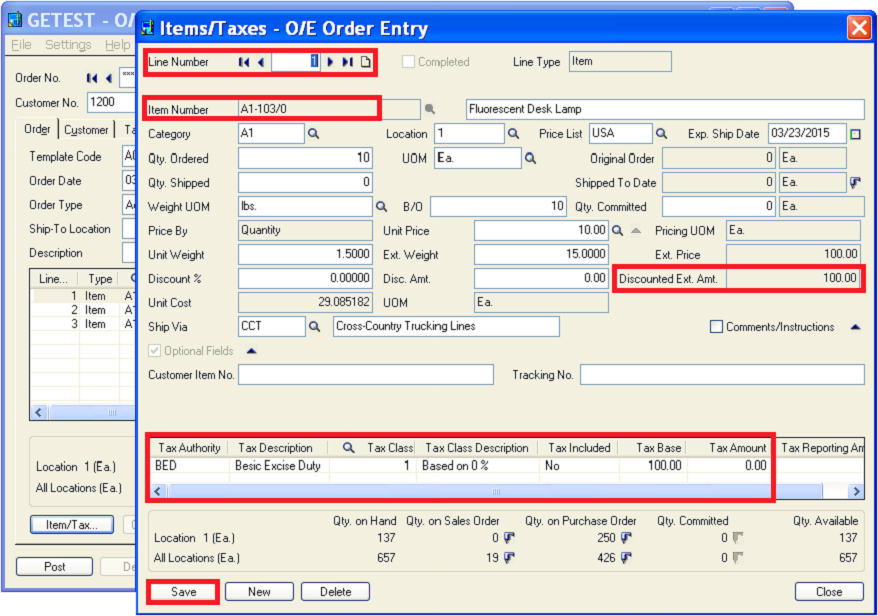

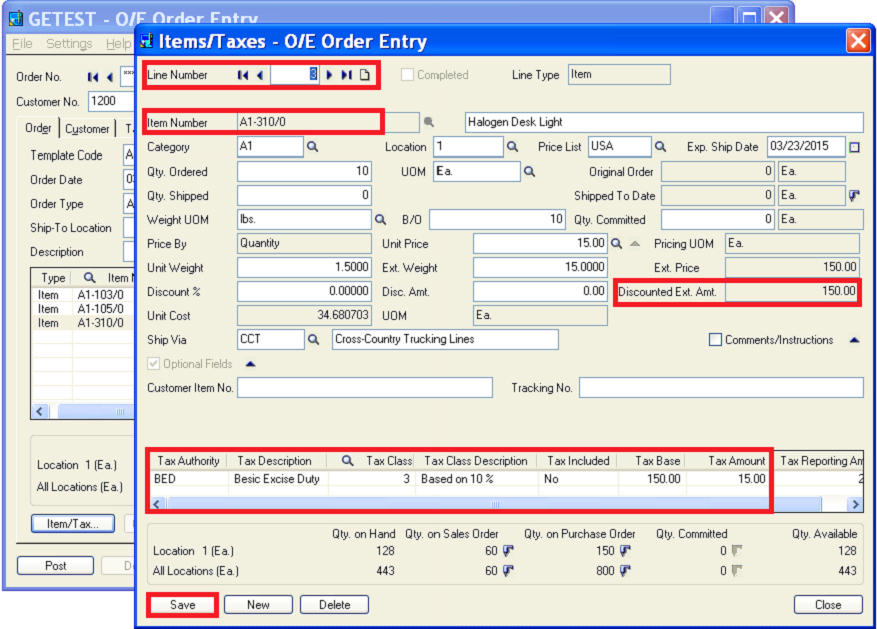

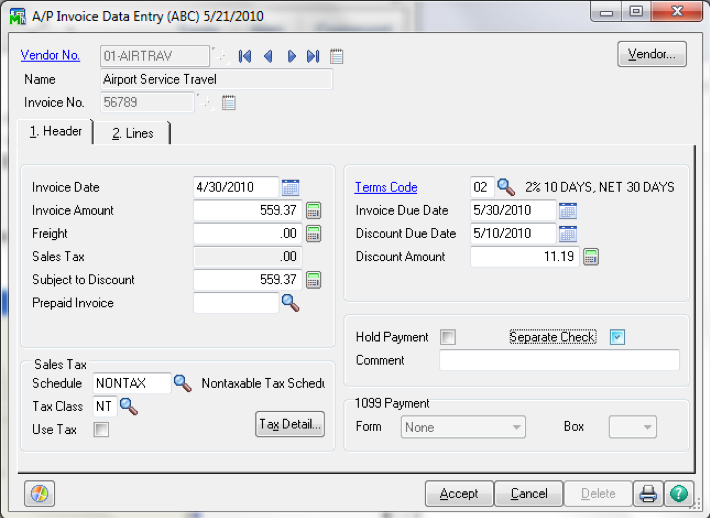

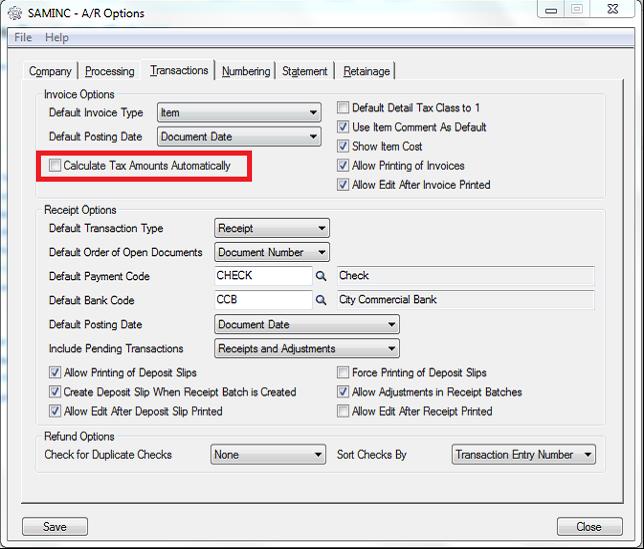

Item wise tax calculation in Sage 300 (for Sales and purchase Transaction) - Sage 300 ERP – Tips, Tricks and Components

Amazon.com: Sage Software Sage 50 Pro Accounting 2022 U.S. Small Business Accounting Software 2022 : Everything Else

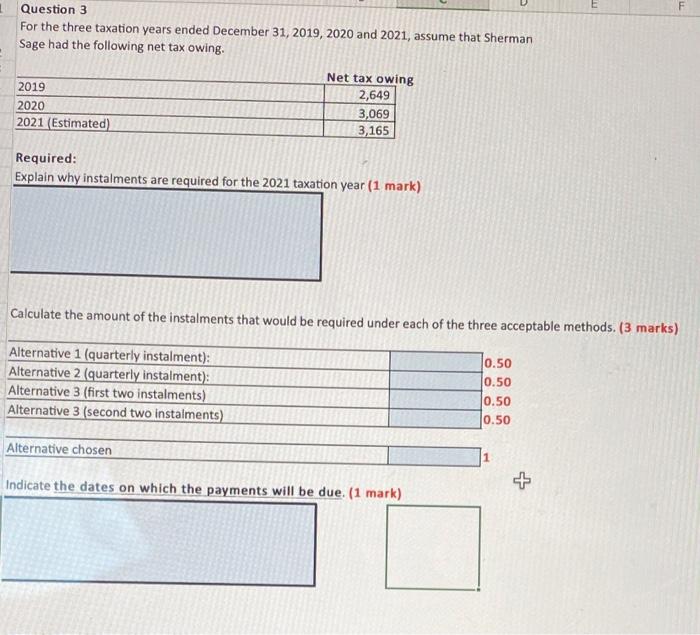

The Earned Income Tax Credit, Family Complexity, and Children's Living Arrangements | RSF: The Russell Sage Foundation Journal of the Social Sciences

Item wise tax calculation in Sage 300 (for Sales and purchase Transaction) - Sage 300 ERP – Tips, Tricks and Components

![Introducing Sage 300 2019 [Best New Features in Latest Version] Introducing Sage 300 2019 [Best New Features in Latest Version]](https://www.top-sage-resellers.com/uploads/5/6/8/7/5687830/sage-crm-sage-300-integration_orig.png)